Take part in the InsurTech revolution

DataArt’s Blockchain Center of Excellence helps insurance companies improve underwriting accuracy, reduce administrative costs, streamline operations, and prevent fraud. We build systems that transform business processes, making them leaner, simpler, and more secure.

Underwriting and claims processing automation

Fraud detection and risk prevention

Digital smart insurance contracts to capture terms and obligations between insurers and clients

New payments model: payments through micro-transactions

Trigger-based invoicing

Improving transparency of historical data

Efficient, transparent and customer-focused claims model

Autonomous microinsurance, usage-based insurance, and peer-to-peer insurance

Streamlined data collection, efficient exchange of information

Technical accounting and settlement

Each step of the claims assessment process involves extensive manual intervention and cross-firm coordination. This process is typically expensive, time consuming and fraught with errors and risks as any claim wrong adjudicated could lead to a potential lawsuit.

The client, a leading financial services and insurance company, sought a solution to these challenges and chose DataArt as their technology implementation partner.

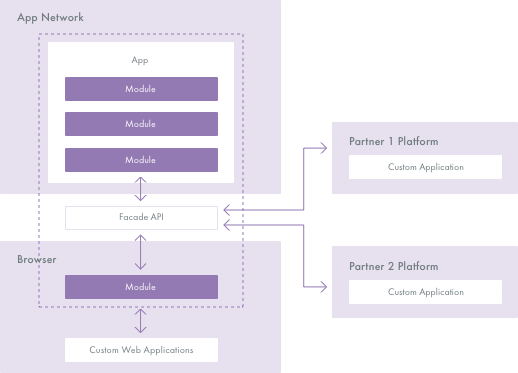

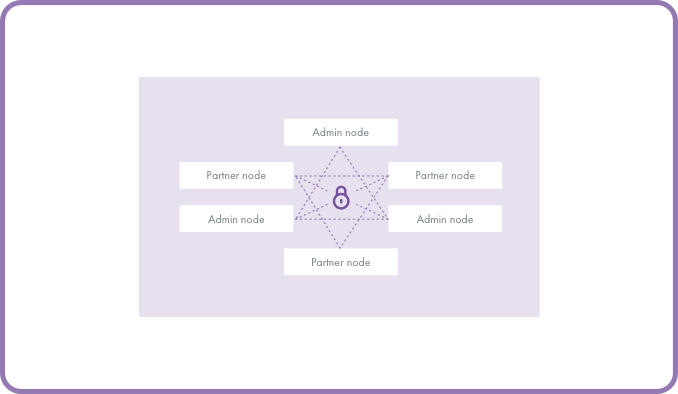

In partnership with the client, DataArt developed a distributed ledger platform that enables peer-to-peer communication mechanism and streamlines the entire contract management process by connecting the entire network of entities over a Blockchain while keeping the data exchange secure and private.

Administration systems are managed separately

Data is at risk of loss or breach because it is exchanged by email

Auditing historical data is difficult

Interacting with multiple systems requires complex processing and is labor intensive

Administration systems are shared by all members

Data is highly secure because it is immutably recorded directly in the distributed ledger

Data is easily auditable over time

Flexible connectivity via open APIs allows seamless system integration

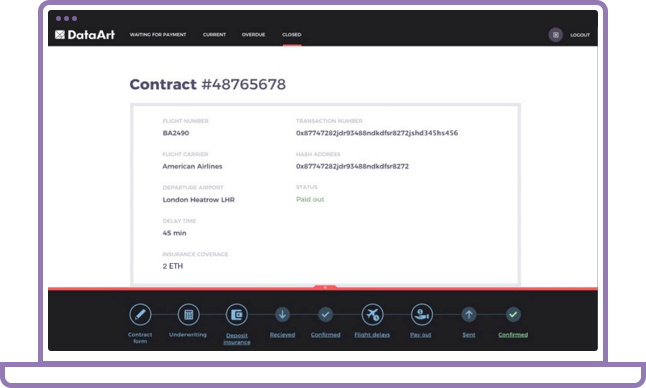

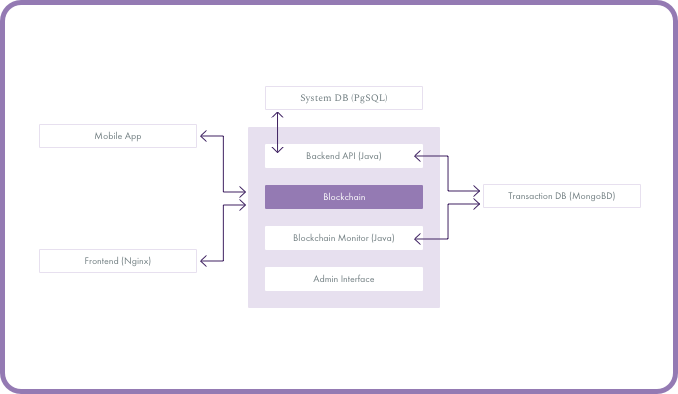

DataArt built a smart contract system on the Ethereum blockchain for passenger flight insurance. If a flight is delayed or canceled, the passenger is paid automatically and immediately.

Watch the video on Youtube

DataArt designed an app that allows governments, public service agencies, and non-government organizations to pay welfare benefits securely and efficiently via mobile devices.

DataArt developed a proprietary cryptocurrency for a large, multinational corporation’s intracompany payments and transfers. Integration-ready API enables cryptocurrency payments to third-party merchants.

DataArt developed a platform that maintains a blockchain ledger for each user, storing historical share data and providing financial operations capabilities.

An embedded auction function allows platform participants to buy shares from each other, making sale/purchase offers at the beginning of an auction. After users place their bids, the system performs an auction settlement, automatically executing matching offers.

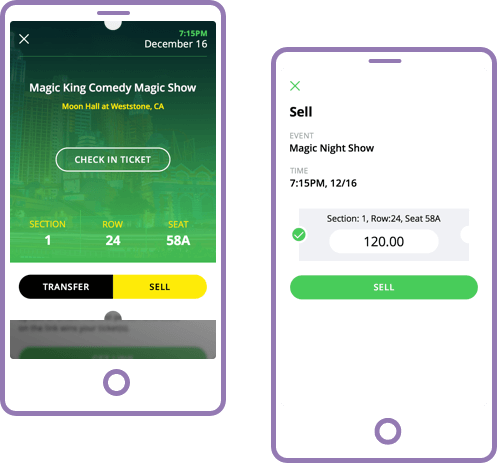

DataArt developed a platform that leverages blockchain and smart contracts to provide unique security and redundancy mechanisms for selling and transferring digital “smart” tickets. The platform’s seamless integration allows customers to digitalize their tickets and generate revenue from secondary ticket sales.

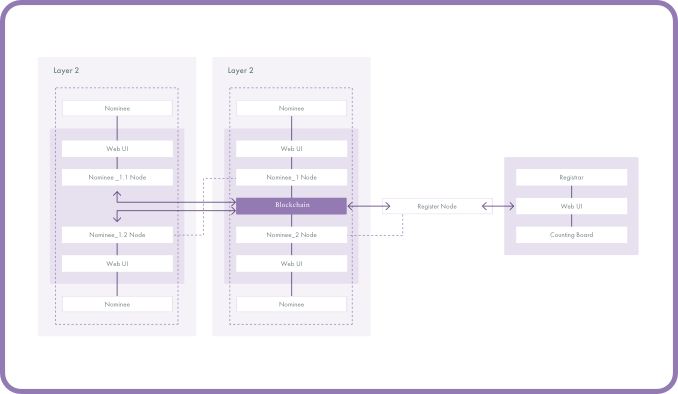

DataArt developed a fully automated, transparent, and secure e-proxy voting platform for a National Settlement Depository. Verified data regarding securities, their ownership, and transactions are recorded on a distributed ledger.

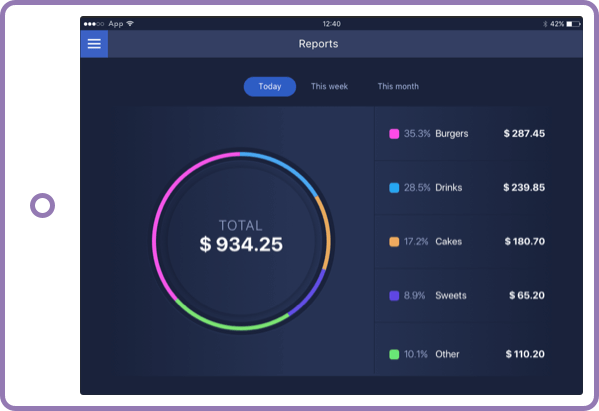

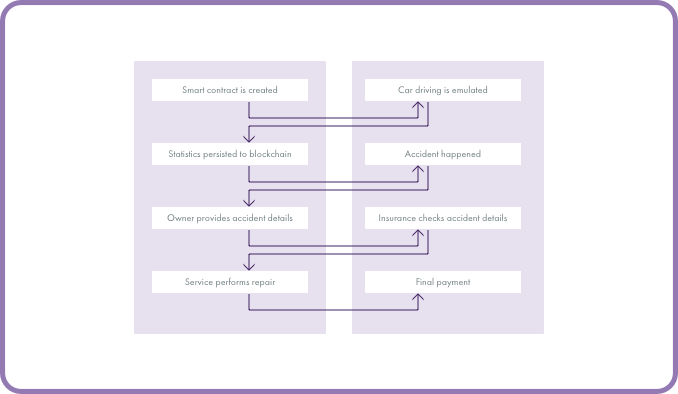

DataArt developed a blockchain-based system that automatically collects, processes, analyzes, visualizes, and shares driving statistics with auto insurers and their commercial partners.

Read more on DataArt.com

DataArt developed a system that helps manage global and local corporate insurance policies across a complex chain of intermediaries. A distributed ledger keeps audit records and provides proof of existence, proof of process, and proof of audit.

The system is designed for companies that provide reinsurance, insurance and other insurance-based forms of risk transfer.

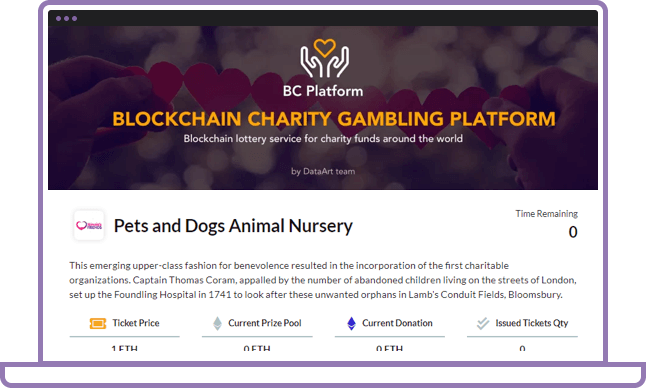

DataArt’s Charity Gambling Platform took first prize at the Malta Blockchain Summit Hackathon in November 2018.

The funding lottery, a blockchain-based solution as a service, combines gambling and charity to encourage social responsibility and fundraising for good causes. Based on Ethereum, the platform connects users and charities, enabling trackable donations.

Your message has been sent